-

BIST 100

10393,90%0,61En Düşük10387,47En Yüksek10441,05

10393,90%0,61En Düşük10387,47En Yüksek10441,05 -

DOLAR

40,18%0,26Alış40,1743Satış40,1779En Yüksek40,2775

40,18%0,26Alış40,1743Satış40,1779En Yüksek40,2775 -

EURO

47,04%0,30Alış47,0236Satış47,0470En Yüksek47,1514

47,04%0,30Alış47,0236Satış47,0470En Yüksek47,1514 -

EUR/USD

1,17%-0,16Alış1,1683Satış1,1684En Yüksek1,1710

1,17%-0,16Alış1,1683Satış1,1684En Yüksek1,1710 -

ALTIN

4306,37%0,56Alış4306,18Satış4306,56En Yüksek4318,98

4306,37%0,56Alış4306,18Satış4306,56En Yüksek4318,98

-

BIST 100

10393,90%0,61En Düşük10387,47En Yüksek10441,05

10393,90%0,61En Düşük10387,47En Yüksek10441,05 -

DOLAR

40,18%0,26Alış40,1743Satış40,1779En Yüksek40,2775

40,18%0,26Alış40,1743Satış40,1779En Yüksek40,2775 -

EURO

47,04%0,30Alış47,0236Satış47,0470En Yüksek47,1514

47,04%0,30Alış47,0236Satış47,0470En Yüksek47,1514 -

EUR/USD

1,17%-0,16Alış1,1683Satış1,1684En Yüksek1,1710

1,17%-0,16Alış1,1683Satış1,1684En Yüksek1,1710 -

ALTIN

4306,37%0,56Alış4306,18Satış4306,56En Yüksek4318,98

4306,37%0,56Alış4306,18Satış4306,56En Yüksek4318,98

- Anasayfa

- Haberler

- Tüm Haberler

- Avea’s new plan

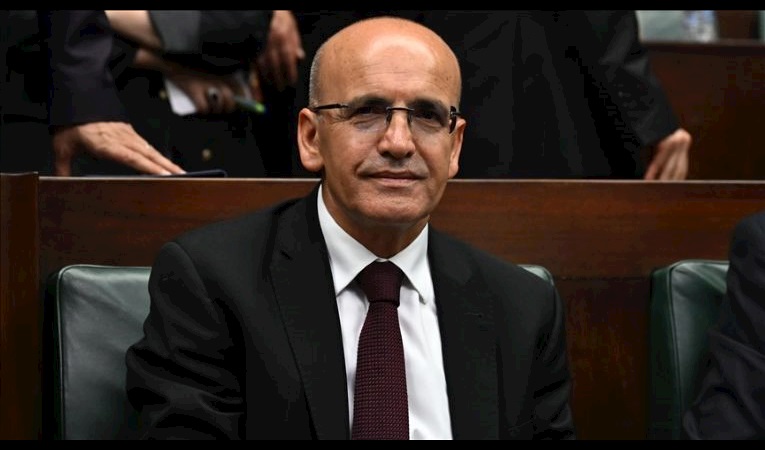

Avea’s new plan

Avea’s new general manager Cüneyt Türktaz has broken his long silence. In the interview which we conducted with him he candidly detailed Avea’s strengths and weaknesses. He explained the company’s ...

Avea’s new general manager Cüneyt Türktaz has broken his long silence. In the interview which we conducted with him he candidly detailed Avea’s strengths and weaknesses. He explained the company’s new business plan. Türktan says that from now on the competition will be in quality rather than price and added that his target is to increase the company’s turnover from $790 million to $1 billion this year. He says that $300 million worth of new investments will be completed this year.

When we heard that the tender for the privatisation of Turk Telekom had been won by the Saudi Oger Group we thought that Cüneyt would have a place in the new organisation. Because a short time after Türktan stepped down as general manager of Turkcell at the end of 2001 he began to work for the Saudi Oger. Most recently he ran the group’s operations in Romania.

When we heard that the tender for the privatisation of Turk Telekom had been won by the Saudi Oger Group we thought that Cüneyt would have a place in the new organisation. Because a short time after Türktan stepped down as general manager of Turkcell at the end of 2001 he began to work for the Saudi Oger. Most recently he ran the group’s operations in Romania.

We asked him what kind of Avea he found and what his plans were for the future. It is clear that Türktan has analysed the companies shortcomings and needs in a very detailed manner. Türktaz says that he found the company a little ‘tired’ and that this year they will prioritise completion of the infrastructure investments and that they will make investments of $300 million. He says that it is necessary to strengthen their distributor network. In 2006 the target is to increase the number of distributors from 380 to 700 and to make the distributors more visible. Türktan says that they achieved operating profitability in 2005 and that the investments mean that they will secure net profits, after tax and depreciation, in 2-3 years.

At the moment the company is 41 percent owned by Turk Telekom, 41 percent by Telecom Italia and 18 percent by İş Bankası but the shareholding structure may change in the near future. Türktan says that the Saudi Oger or Turk Telecom wanted to use their right to buy the shares of Telecom Italia.

Here are the answers that Türktan gave to our questions.

* Could you give us some information about the current state of turnover, number of subscribers and market share and what your targets are?

At the moment we have a turnover of around $790 million. Our target is to increase this to $1 billion by the end of 2006. We are targeting increasing the per capita income. But I don’t want to announce the figure at the moment.

* For a mobile operator to work profitability in Turkey what level does it need to reach in terms of number of subscribers and per capita subscriber revenue?

Operational profitability means being able to meet expenditure before tax and depreciation. I mean, operational revenue and subscriber revenue meeting the company’s operating expenses. Of course, we are not including investments.

As of today, Avea has reached breakeven point. At the end of 2005 Avea had 6.5 million subscribers and per capita subscriber revenue achieved breakeven point.

* So when will there be a balance sheet profit?

It is different with telecommunication companies because telecommunications companies make major investments. More investments are made in the early years, which means that the real profitability only becomes evident later. But operators who post large losses because of investments, once they have broken even profits rise rapidly afterwards.

There will be investments i the years ahead. But if everything goes as we want then in 2-3 years we shall achieve financial profitability.

* When we look at your partnership structure, 41 percent of Avea is owned by Turk Telekom, 41 percent by Telecom Italia and 18 percent by İş Bankası. There is no single majority shareholder. Does the decision-making process function smoothly?

The board of directors functions well and there are no problems. At the moment, the board of directors is working in harmony. We have 10 members of our board of directors. Four are from Turk Telekom, four from Telecom Italia and two from İş Bankası.

* Will there be any change in the distribution of shares in the near future?

As you know, this is on the agenda. An announcement has been made. During the privatisation process there was an agreement between Turk Telekom and the Oger Group. According to this agreement, its shares will be bought by either Turk Telekom or the Oger Group. Work on this issue is continuing. But I don’t know when it will be concluded. Turk Telekom or the Oger Group can give a clearer answer to this question.

* According to an evaluation by İş Bankası, Avea has a value of $3.4 billion. Do you think that is Avea’s real value?

This figure was arrived at through calculations using a theoretical method. I always say: “The true value of the company will become clear when it goes public.”

* In a previous interview with us you said: “All the operators focus on a target market. They should diversify to catch niche markets.” How will Avea diversify in this regard?

It is important to identify the segments first. After that, you need to analyse the segment’s lifestyle; what they eat, what they drink and what kind of needs they have. We are currently analysing these segments. We are establishing information such as when they use their telephones, how much they use them and what for and how much money they want to spend.

We have some successful packages for students and those who work in the public sector. We are aiming to increase the number of this type of package. We want to produce packages which are designed for niche areas. We think that the corporate services market is still virgin territory.

SEDEF SEÇKİN BÜYÜK

[email protected]

Türkiye ve dünya ekonomisine yön veren gelişmeleri yorulmadan takip edebilmek için her yeni güne haber bültenimiz “Sabah Kahvesi” ile başlamak ister misiniz?