-

BIST 100

10063,42%0,65En Düşük9986,70En Yüksek10090,62

10063,42%0,65En Düşük9986,70En Yüksek10090,62 -

DOLAR

40,03%-0,03Alış40,0283Satış40,0383En Yüksek40,0834

40,03%-0,03Alış40,0283Satış40,0383En Yüksek40,0834 -

EURO

46,95%0,01Alış46,9447Satış46,9535En Yüksek47,0598

46,95%0,01Alış46,9447Satış46,9535En Yüksek47,0598 -

EUR/USD

1,17%-0,12Alış1,1711Satış1,1712En Yüksek1,1732

1,17%-0,12Alış1,1711Satış1,1712En Yüksek1,1732 -

ALTIN

4233,84%-0,40Alış4233,32Satış4234,37En Yüksek4259,86

4233,84%-0,40Alış4233,32Satış4234,37En Yüksek4259,86

-

BIST 100

10063,42%0,65En Düşük9986,70En Yüksek10090,62

10063,42%0,65En Düşük9986,70En Yüksek10090,62 -

DOLAR

40,03%-0,03Alış40,0283Satış40,0383En Yüksek40,0834

40,03%-0,03Alış40,0283Satış40,0383En Yüksek40,0834 -

EURO

46,95%0,01Alış46,9447Satış46,9535En Yüksek47,0598

46,95%0,01Alış46,9447Satış46,9535En Yüksek47,0598 -

EUR/USD

1,17%-0,12Alış1,1711Satış1,1712En Yüksek1,1732

1,17%-0,12Alış1,1711Satış1,1712En Yüksek1,1732 -

ALTIN

4233,84%-0,40Alış4233,32Satış4234,37En Yüksek4259,86

4233,84%-0,40Alış4233,32Satış4234,37En Yüksek4259,86

- Anasayfa

- Haberler

- Tüm Haberler

- CEO's 2014 agenda

CEO's 2014 agenda

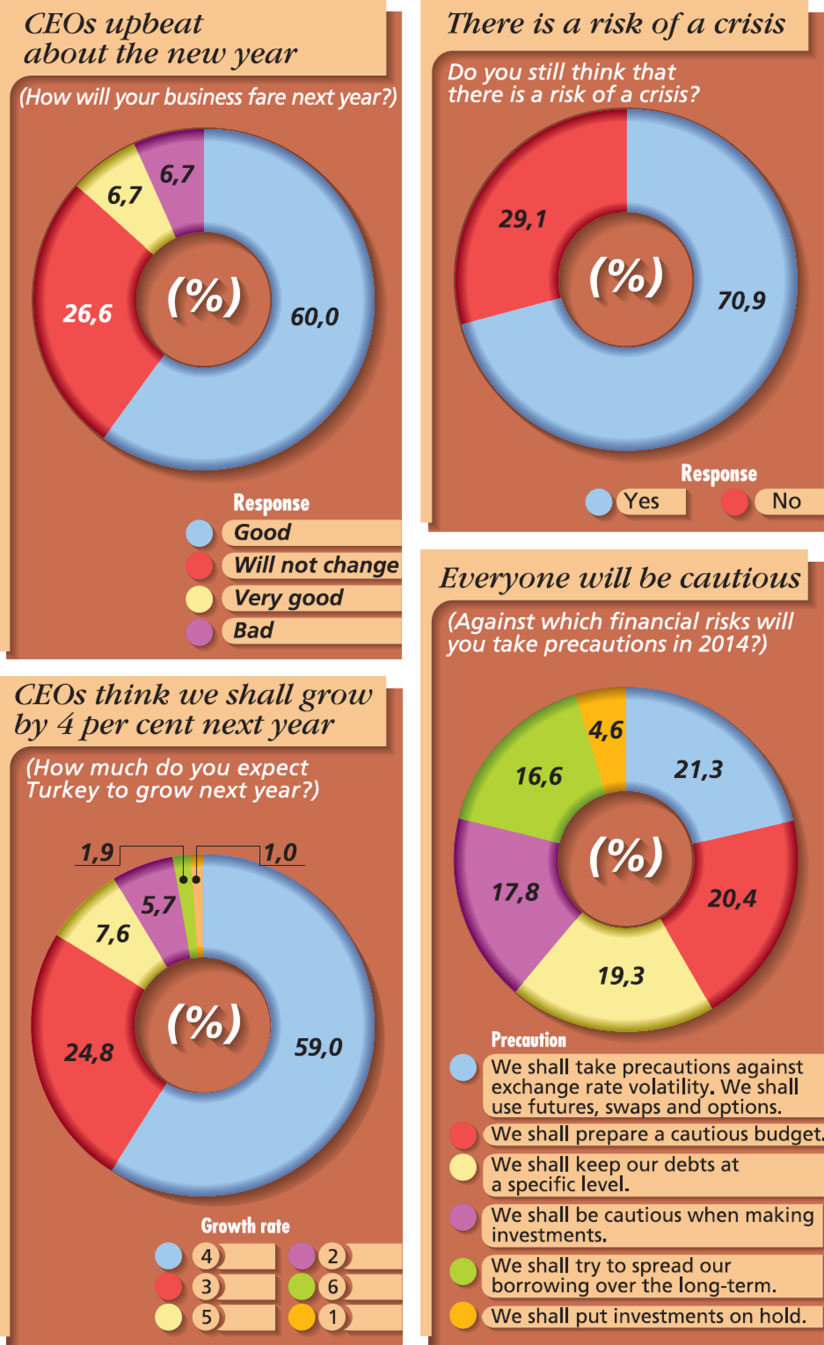

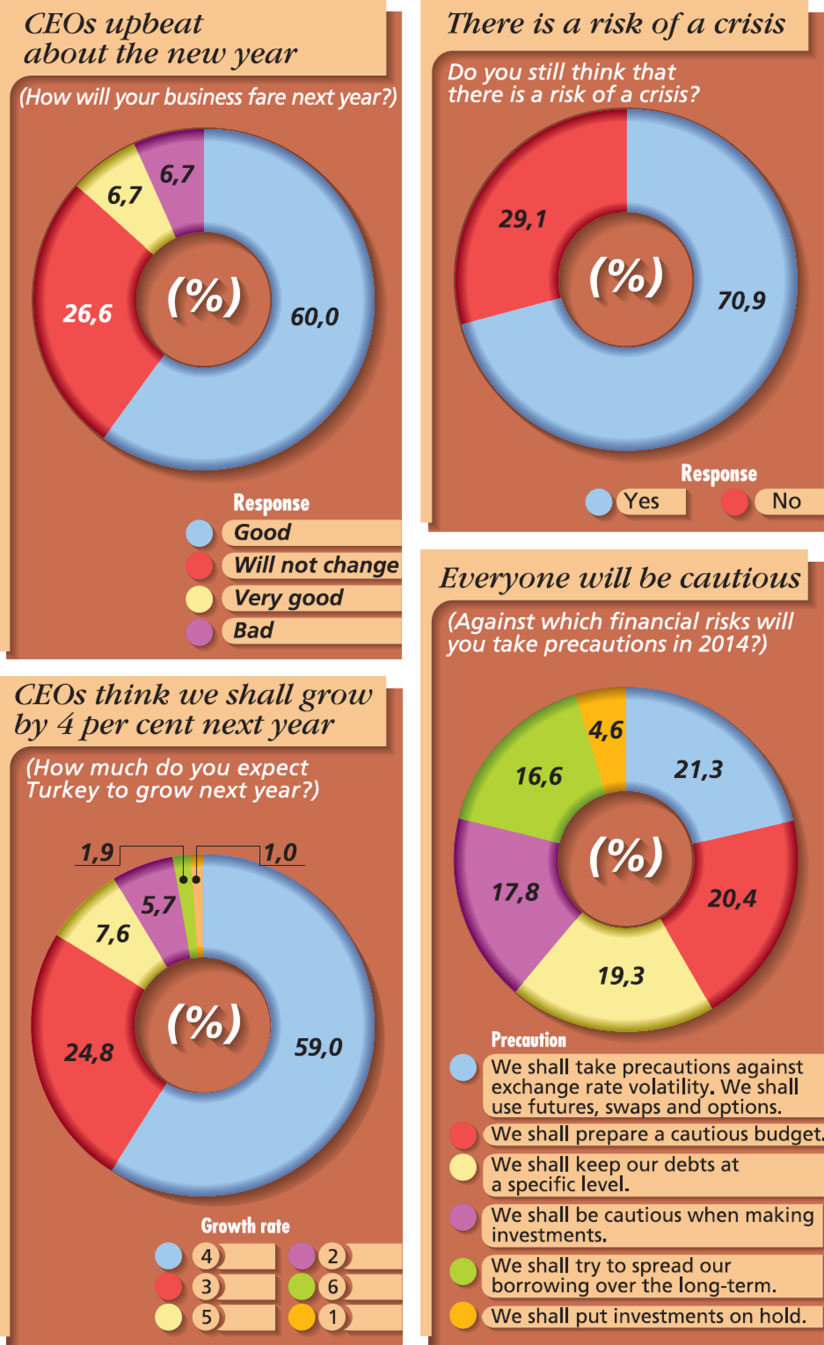

A total of 60 per cent of the 106 CEOs who participated in the survey said that they expected their business to go well next year, while 7 per cent thought it would go very well.

25.03.2014 13:41:410

The Turkish economy is going through extremely lively times. So, what is on CEOs’ agendas in this situation? Capital’s “CEO Profile 2014”, which has already become a tradition, illuminates important issues at a time when the problems faced by the business community have increased.

A total of 60 percent of the 106 CEOs who participated in the survey said that they expected their business to go well next year, while 7 per cent thought it would go very well. 70.9 per cent thought that there was still a risk of a crisis. But there were also those who predicted that the encouraging signals coming from Europe would increase exports and boost growth. Productivity once again tops the CEOs’ agendas.

Click image to see the table.

WATCH OUT FOR FINANCIAL RISKS!

WATCH OUT FOR FINANCIAL RISKS!

There are many financial risks in 2014. All of the CEOs who participated in the survey said that they would be cautious in the face of these risks. The most important risk that the CEOs will take measures against is volatility in the exchange rate. 21.3 per cent of the CEOs say: “We shall take measures against exchange rate volatility. We shall use futures, swaps and options.”

Index Group CEO Erol Bilecik is one of these executives. Bilecik says: “I see exchange rate differences and developments that could lead to this as the most important financial risk. We shall definitely use forwarding to hedge against this kind of problem with the TL.” The end of the FED’s quantitative easing is expected to result in money leaving developing countries all over the world.~

Akfen CEO Süha Güçsav says: “This is an extremely important development for a country like Turkey whose current account deficit makes it dependent on foreign financing for growth. The result is, as we saw in 2013, an increase in interest rates and an extremely important risk in terms of raising funding costs.” Kibar Holding CEO Ali Kibar notes that the pressure resulting from FED decisions increases foreign exchange volatility. He continues as follows:

PRODUCTIVITY IS ON THE AGENDA

Productivity is now at the top of the CEOs’ agendas, Productivity tops the agendas of 35.8 per cent of CEOs, followed by growth for 19.8 per cent and sustainability for 17 per cent. Coming to how productivity will be achieved...

62 per cent of CEOs are looking to make savings and reduce costs. 7.4 per cent say that they will cut back on investments. 6.6 per cent have decided to use foreign sources of funding. Productivity tops the agenda of Migros General Manager Özgür Tort. Tort summarises his productivity strategy as follows: “An approach based on productivity, double digit growth, reaching the most customers through the most outlets and providing our customers with a unique, high standard shopping experience are items which are permanently at the top of our agenda.”

ORGANIC OR INORGANIC?

Growth is another item that tops CEOs’ agendas. So how will companies grow? 2013 was an extremely active year in terms of mergers and acquisitions. There were 132 deals in the first quarter.

These deals were dominated by industrial production, retailing, services, energy and financial services. So what do CEOs think about this issue in 2014? Will they opt for organic or inorganic growth? Which sectors do they think will come to the fore in 2014? In which regions are they looking for opportunities?~

According to the CEO Profile survey, 51 per cent of CEOs said that they would grow organically in 2014. 24 per cent said that there was a possibility of acquiring a company, while 9 per cent said that they may buy a plant and 6 per cent said that they may buy a brand,

THE DIRECTION OF INVESTMENTS

Each year, Capital’s CEO Profile survey reveals CEOs’ investment plans. 25 per cent of CEOs are planning investments of $10-50 million in 2014, while 21.1 per cent are looking at investments of $1-5 million and 20.2 per cent at investments of $5-10 million.

Coming to the details of these investments. Yıldız Entegre General Manager Hakkı Yıldız says that “investment is the first item on our agenda” and notes that they realise large-scale investments every year. He had the following to say about their new investment plans:

“Now we are looking both to open up to the outside world in this sector and to invest in a different sector. 2014 will be the scene of some very exciting beginnings for us. When a peaceful environment is established in its neighbouring countries, Turkey will become a magnet in the medium to long-term.”

A total of 60 percent of the 106 CEOs who participated in the survey said that they expected their business to go well next year, while 7 per cent thought it would go very well. 70.9 per cent thought that there was still a risk of a crisis. But there were also those who predicted that the encouraging signals coming from Europe would increase exports and boost growth. Productivity once again tops the CEOs’ agendas.

Click image to see the table.

WATCH OUT FOR FINANCIAL RISKS!

WATCH OUT FOR FINANCIAL RISKS!There are many financial risks in 2014. All of the CEOs who participated in the survey said that they would be cautious in the face of these risks. The most important risk that the CEOs will take measures against is volatility in the exchange rate. 21.3 per cent of the CEOs say: “We shall take measures against exchange rate volatility. We shall use futures, swaps and options.”

Index Group CEO Erol Bilecik is one of these executives. Bilecik says: “I see exchange rate differences and developments that could lead to this as the most important financial risk. We shall definitely use forwarding to hedge against this kind of problem with the TL.” The end of the FED’s quantitative easing is expected to result in money leaving developing countries all over the world.~

Akfen CEO Süha Güçsav says: “This is an extremely important development for a country like Turkey whose current account deficit makes it dependent on foreign financing for growth. The result is, as we saw in 2013, an increase in interest rates and an extremely important risk in terms of raising funding costs.” Kibar Holding CEO Ali Kibar notes that the pressure resulting from FED decisions increases foreign exchange volatility. He continues as follows:

PRODUCTIVITY IS ON THE AGENDA

Productivity is now at the top of the CEOs’ agendas, Productivity tops the agendas of 35.8 per cent of CEOs, followed by growth for 19.8 per cent and sustainability for 17 per cent. Coming to how productivity will be achieved...

62 per cent of CEOs are looking to make savings and reduce costs. 7.4 per cent say that they will cut back on investments. 6.6 per cent have decided to use foreign sources of funding. Productivity tops the agenda of Migros General Manager Özgür Tort. Tort summarises his productivity strategy as follows: “An approach based on productivity, double digit growth, reaching the most customers through the most outlets and providing our customers with a unique, high standard shopping experience are items which are permanently at the top of our agenda.”

ORGANIC OR INORGANIC?

Growth is another item that tops CEOs’ agendas. So how will companies grow? 2013 was an extremely active year in terms of mergers and acquisitions. There were 132 deals in the first quarter.

These deals were dominated by industrial production, retailing, services, energy and financial services. So what do CEOs think about this issue in 2014? Will they opt for organic or inorganic growth? Which sectors do they think will come to the fore in 2014? In which regions are they looking for opportunities?~

According to the CEO Profile survey, 51 per cent of CEOs said that they would grow organically in 2014. 24 per cent said that there was a possibility of acquiring a company, while 9 per cent said that they may buy a plant and 6 per cent said that they may buy a brand,

THE DIRECTION OF INVESTMENTS

Each year, Capital’s CEO Profile survey reveals CEOs’ investment plans. 25 per cent of CEOs are planning investments of $10-50 million in 2014, while 21.1 per cent are looking at investments of $1-5 million and 20.2 per cent at investments of $5-10 million.

Coming to the details of these investments. Yıldız Entegre General Manager Hakkı Yıldız says that “investment is the first item on our agenda” and notes that they realise large-scale investments every year. He had the following to say about their new investment plans:

“Now we are looking both to open up to the outside world in this sector and to invest in a different sector. 2014 will be the scene of some very exciting beginnings for us. When a peaceful environment is established in its neighbouring countries, Turkey will become a magnet in the medium to long-term.”

Türkiye ve dünya ekonomisine yön veren gelişmeleri yorulmadan takip edebilmek için her yeni güne haber bültenimiz “Sabah Kahvesi” ile başlamak ister misiniz?

İLGİNİZİ ÇEKEBİLİR

Yorum Yaz

Capital Dergisi'nden son haberleri bildirim olarak almak ister misiniz?