-

BIST 100

11632,38%1,17En Düşük11510,19En Yüksek11675,73

11632,38%1,17En Düşük11510,19En Yüksek11675,73 -

DOLAR

43,04%0,05Alış43,0437Satış43,0459En Yüksek43,0524

43,04%0,05Alış43,0437Satış43,0459En Yüksek43,0524 -

EURO

50,31%-0,19Alış50,3070Satış50,3205En Yüksek50,4892

50,31%-0,19Alış50,3070Satış50,3205En Yüksek50,4892 -

EUR/USD

1,17%-0,37Alış1,1679Satış1,1680En Yüksek1,1725

1,17%-0,37Alış1,1679Satış1,1680En Yüksek1,1725 -

ALTIN

6135,69%2,33Alış6135,53Satış6135,84En Yüksek6136,83

6135,69%2,33Alış6135,53Satış6135,84En Yüksek6136,83

-

BIST 100

11632,38%1,17En Düşük11510,19En Yüksek11675,73

11632,38%1,17En Düşük11510,19En Yüksek11675,73 -

DOLAR

43,04%0,05Alış43,0437Satış43,0459En Yüksek43,0524

43,04%0,05Alış43,0437Satış43,0459En Yüksek43,0524 -

EURO

50,31%-0,19Alış50,3070Satış50,3205En Yüksek50,4892

50,31%-0,19Alış50,3070Satış50,3205En Yüksek50,4892 -

EUR/USD

1,17%-0,37Alış1,1679Satış1,1680En Yüksek1,1725

1,17%-0,37Alış1,1679Satış1,1680En Yüksek1,1725 -

ALTIN

6135,69%2,33Alış6135,53Satış6135,84En Yüksek6136,83

6135,69%2,33Alış6135,53Satış6135,84En Yüksek6136,83

- Anasayfa

- Haberler

- Tüm Haberler

- Factory exports have surpassed 100

Factory exports have surpassed 100

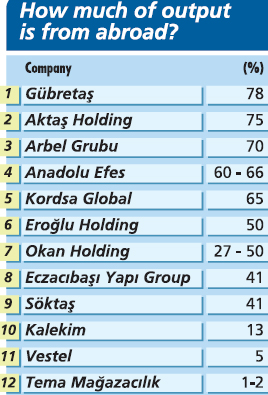

Here is the global production map of the giant groups...

1.01.2012 00:00:000

Over the last 10 years there has been a rapid rise in the number of companies from a broad range of sectors, from electronic goods to ceramics, textile retailing and petrochemicals, which have shifted their production abroad. The Turks who have invested in production abroad have done so either by buying existing factories or by building entirely new ones. The factories owned by Turks are spread across a wide area, from Europe to the Caucasus, the Far East and the Pacific.

Over the last 10 years there has been a rapid rise in the number of companies from a broad range of sectors, from electronic goods to ceramics, textile retailing and petrochemicals, which have shifted their production abroad. The Turks who have invested in production abroad have done so either by buying existing factories or by building entirely new ones. The factories owned by Turks are spread across a wide area, from Europe to the Caucasus, the Far East and the Pacific.In which region are they?

The Turkish companies which have gone global in terms of their production are today active in nearly 100 countries on the European, Asian, African, American and Australia continents. Russia and the countries of Central Asia account for a particularly important share of Turkish companies' factory investments. Companies such as Anadolu Efes, Şişecam, Coca-Cola İçecek, Arçelik, Boydak Holding, the Eczacıbaşı Yapı Group, Hayat Kimya, the Kale Group, Okan Holding, Starwood, Vestel and Yıldız Holding produce a significant proportion of their output in Russia and neighboring countries. There are also Turkish factories in African countries. The Turkish companies which have opted for this region include Coca-Cola İçecek again, the Arbel Group, Arçelik, Evyap, Colin's, LC Waikiki and Yıldız Holding. The companies which produce on the American continent include the Arbel Group, Aktaş Holding, Kordsa Global, Sarkuysan and Yıldız Holding. Giants such as the Eczacıbaşı Yapı Group, the Kale Group, Şişecam, Yıldız Holding, Kayalar Kimya, Arçelik, Kordsa Global and Kastamonu Entegre produce in Europe. Those who have taken advantage of lower costs to produce in the Far East include Arçelik again, the Anadolu Group, the Arbel Group, Söktaş, Kordsa Global, Aktaş Holding, Tema Mağazacılık and Yıldız Holding.

Those who are most widely spread

Those who are most widely spreadWhen we study the global production map for Turkish companies, we see that some companies are distributed throughout virtually the entire world. Kordsa Global produces at factories in Turkey and Germany in the Europe, Middle East and Africa (EMEA) region, Indonesia and Thailand in the Asia Pacific region, the USA in North America and Argentina and Brazil in South America. Aktaş Holding is another of those which has opted to spread throughout the world. Aktaş Holding Board Chair Şahap Aktaş says: "At the moment, our factories are continuing to grow by creating their own markets. They are increasing their market shares by the day. We are the third largest player worldwide in our sector." The Anadolu Group is another which has spread all over the world. It produces beer, malt, aerated and nonaerated drinks at its plants in Russia, Kazakhstan, Moldova, Georgia, Turkmenistan, Azerbaijan, Iraq, Kirghizstan, Pakistan and Jordon.~

The advantage of regional production

Hakan Tiftik, CEO of Kordsa Global, which is one of those which has the most widespread production facilities, explains the regional advantages of their production as follows: "In America, Argentina and Indonesia you are close to sources of raw materials, while in Asia Pacific and Egypt it is cheap labor that comes to the fore." Eroğlu Holding Board Member Ümmet Eroğlu says that the incentives that are applied in the free trade zone in Egypt make it attractive. Tema Mağazacılık Board Member Ted Southall says that there are advantages to producing in Egypt, such as cheap labor and low energy costs, and adds: "There are three advantages to producing machine-knitted fabrics in Bangladesh. The labor costs are lower. There is a very high capacity for machine-knitted fabric production. And Bangladesh has advantages when compared with other countries in terms of import duties." Söktaş Board Chair Muharrem Kayhan notes that, in addition to the market potential, they produce in India because of being able to procure raw materials locally, a young, English-speaking educated workforce, and the government's policies for investments in textiles and clothing.

The most ambitious investment plans

Almost all of the companies that we covered in our survey are making investments in their target locations or planning them. For example, Kastamonu Entegre has allocated a budget of $320 million for investments abroad. The group's continuing investment in Romania includes a chipboard plant with an annual capacity of 500,000 cubic meters. This factory is expected to begin operations in the first quarter of 2012. The ongoing MDF plant in Tatarstan will begin production at the end of 2012 and will account for 27 percent of MDF's total production capacity. Kordsa Global is continuing with its polyester yarn and tire cord investments in Indonesia. It plans to modernize and increase capacity in Egypt. Aktaş Holding is currently building its own plant in China. The factor represents an investment of $12.5 million, will have an annual production of 1.5 million units and will begin operations in 2012. Board Chair Şahap Aktaş says that they are planning to invest in a technology intensive plant in Russia in 2012.

Türkiye ve dünya ekonomisine yön veren gelişmeleri yorulmadan takip edebilmek için her yeni güne haber bültenimiz “Sabah Kahvesi” ile başlamak ister misiniz?