-

BIST 100

11220,17%0,62En Düşük11102,18En Yüksek11235,51

11220,17%0,62En Düşük11102,18En Yüksek11235,51 -

DOLAR

42,94%0,00Alış42,9254Satış42,9456En Yüksek42,9361

42,94%0,00Alış42,9254Satış42,9456En Yüksek42,9361 -

EURO

50,49%0,03Alış50,4195Satış50,5544En Yüksek50,4871

50,49%0,03Alış50,4195Satış50,5544En Yüksek50,4871 -

EUR/USD

1,17%0,02Alış1,1746Satış1,1747En Yüksek1,1750

1,17%0,02Alış1,1746Satış1,1747En Yüksek1,1750 -

ALTIN

6002,60%0,17Alış6001,91Satış6003,30En Yüksek6002,56

6002,60%0,17Alış6001,91Satış6003,30En Yüksek6002,56

-

BIST 100

11220,17%0,62En Düşük11102,18En Yüksek11235,51

11220,17%0,62En Düşük11102,18En Yüksek11235,51 -

DOLAR

42,94%0,00Alış42,9254Satış42,9456En Yüksek42,9361

42,94%0,00Alış42,9254Satış42,9456En Yüksek42,9361 -

EURO

50,49%0,03Alış50,4195Satış50,5544En Yüksek50,4871

50,49%0,03Alış50,4195Satış50,5544En Yüksek50,4871 -

EUR/USD

1,17%0,02Alış1,1746Satış1,1747En Yüksek1,1750

1,17%0,02Alış1,1746Satış1,1747En Yüksek1,1750 -

ALTIN

6002,60%0,17Alış6001,91Satış6003,30En Yüksek6002,56

6002,60%0,17Alış6001,91Satış6003,30En Yüksek6002,56

- Anasayfa

- Haberler

- Tüm Haberler

- How can bad profits be prevented?

How can bad profits be prevented?

You may ask: “How can there be bad profits?” But the famous management expert Fred Reichheld, whose book has become a best-seller, warns: “Bad profit brings success in the short-t...

You may ask: “How can there be bad profits?” But the famous management expert Fred Reichheld, whose book has become a best-seller, warns: “Bad profit brings success in the short-term but in the long-term it sinks a company.” Many companies have run into difficulties or even collapsed as a result. Reichheld says: “When customers understand this they sever relations and their loyalty is lost.” He suggests some newly developed methods to measure bad profit.

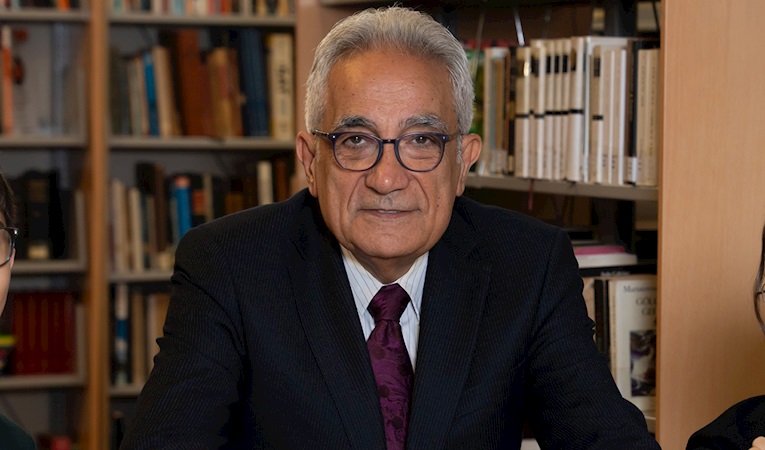

Fred Reichheld is one of the top executives at Bain & Co and in his book ‘Ultimate Question’ he addresses the subject of good profit and bad profit. He says that, in their pursuit of growth, companies seek profit regardless of whether it is ‘good’ or ‘bad’. Most of the time this results in them losing customers. Reichheld says that the way to avoid this is: “To distinguish between good and bad profit and use the right method to measure them”. He recommends the Net Promoter Score as the best way to do this.

Fred Reichheld says that, as they pursue profits, companies today should look at the quality of the profit not just the quantity. He answered our questions as follows.

* You divide profit into good and bad. How can profit be bad?

People think that profit is the one reliable way of measuring a company and the only value which is closely monitored. During a specific period, companies can focus on results and securing profits whatever the cost; and they are usually successful in this regard.

The only problem is this: if these figures are the result of bad profits then they are not an indicator of the true financial situation of the company. Even if these profits have been calculated in full accordance with generally accepted accounting principles, they can still have an negative impact on the growth of the business because they have damaged some important relationships and alienated customers. If the profits have been secured as a result of customers being treated in the wrong way, not shown respect, charged excessively high prices, hit with hidden costs and annoying, then all of these things may alienate the customers.

Even if such a strategy gives a short term boost to the company’s accounts, the costs of bad profits will very quickly become apparent. When customers feel that they have been misled, they stop investing in relationships and their loyalty is lost. Without loyalty it is impossible to record real growth.

* So how can the average executive distinguish between the two?

There is no doubt that your accountants are not going to tell you the difference between the two because they both look the same on the balance sheet. Bad profit is profit which is expensive because it damages customer relations. When customers are misled, ignored or treated badly then the profit that is acquired is bad profit. Bad profit does not create value. On the contrary, it reduces value. If sales representatives charge excessive prices, or sell bad products, the profit that results is bad profit.

* What are the basic characteristics of bad profit? How can companies decide whether their profits are good or bad?

Good profit can be easily distinguished from bad profit: customers who are satisfied with the goods and services they have received are enthusiastic, cooperate and provide more follow-up business. The key for a company which cannot sever its links with bad profits is to begin to build relationships with its customers. These relationships should not be limited to increasing loyalty, they should also secure the good profits which are essential for growth.

Traditional accounting does not distinguish between good profits and bad profits but companies which use a method known as the ‘Net Promoter Score’ or NPS will see a big difference. It is easy to gauge customers’ loyalty and their attitude towards the company through the answers given to the ‘ultimate question’. A high NPS shows that the customer is enthusiastic and very loyal and is an indication of good profit.

* What is Net Promoter Score and how is it measured?

To explain it in simple terms: NPS shows the difference between good profits which have been secured by companies which have given greater value to their customers and bad profits which are earned despite the customer. What we call the ‘ultimate question’ is a single fundamental question. It allows companies to monitor the development of customer loyalty and the impact this has on profitable growth. The question is: “Would you recommend us to a friend of yours?”

The customer answers can be graded on a scale of 0 to 10 and then divided into three categories. Those whose answers have been resulted in them receiving a score of 9 or 10 points are described as ‘promoters’. That means that they are the most loyal customers and what they say about the company has a positive impact on the market. The customers whose answers result in them receiving a score of 7 or 8 points are described as ‘passive’. The customers in this category are happy with the services they have received but they could easily move to rival companies if they receive an attractive offer.

Those people whose scores result in them receiving scores between 0 and 6 are described as ‘detractors’. They are not satisfied with the product or services and, as a result, they may produce a negative impression on the market. This situation will not only damage the company’s reputation but prevent growth.

These are the data used to measure NPS. Using this data, you can work out the percentage of customers who receive 9 or 10 and can be described as promoters and what percentage are detractors. The results that are produced measure the health of the relationship between the company and its customers and provides an important indication of the potential for growth.

Where Should One Look For Bad Profit?

Finance In fact you do not have to look too far to see examples of bad profits. For example, ‘trust’ is one of the most important themes in advertisements in the financial sector. But this image can be undermined by commission fees and interest rates on overdue payments.

Health And Pharmaceuticals If you take a glance at the health sector you can see that many hospitals do not want to reveal what agreement they have made with the insurance companies. Many insurers do everything possible to exclude certain ailments from the scope of their coverage. Most pharmaceutical companies have different relationships with doctors in order to ensure that their own products are written on the prescriptions.

Airlines Many airlines change the prices so much during the day that nobody knows the ‘real’ price. What is interesting is that it is generally the best customers who are most deceived.

And Cost The biggest damage accruing from bad profit is the creation of ‘mud-slinging’ customers. Customers who are not happy or have suffered a loss go to another company and deter others. Continually reporting problems can increase the cost of services, their complaints can create problems for customer services, and they can relay their complaints to their acquaintances or even the press. Indeed, this can seriously damage the reputation of a company. In the past, a customer who was not happy could speak with and influence 10 friends. Now, because of the Internet, this number can rise to thousands or millions.

Türkiye ve dünya ekonomisine yön veren gelişmeleri yorulmadan takip edebilmek için her yeni güne haber bültenimiz “Sabah Kahvesi” ile başlamak ister misiniz?