-

BIST 100

11341,90%0,06En Düşük11291,08En Yüksek11354,26

11341,90%0,06En Düşük11291,08En Yüksek11354,26 -

DOLAR

42,78%0,12Alış42,7554Satış42,8038En Yüksek42,8350

42,78%0,12Alış42,7554Satış42,8038En Yüksek42,8350 -

EURO

50,12%-0,15Alış50,0692Satış50,1727En Yüksek50,2967

50,12%-0,15Alış50,0692Satış50,1727En Yüksek50,2967 -

EUR/USD

1,17%-0,12Alış1,1708Satış1,1709En Yüksek1,1739

1,17%-0,12Alış1,1708Satış1,1709En Yüksek1,1739 -

ALTIN

5967,26%0,21Alış5963,89Satış5970,64En Yüksek5994,10

5967,26%0,21Alış5963,89Satış5970,64En Yüksek5994,10

-

BIST 100

11341,90%0,06En Düşük11291,08En Yüksek11354,26

11341,90%0,06En Düşük11291,08En Yüksek11354,26 -

DOLAR

42,78%0,12Alış42,7554Satış42,8038En Yüksek42,8350

42,78%0,12Alış42,7554Satış42,8038En Yüksek42,8350 -

EURO

50,12%-0,15Alış50,0692Satış50,1727En Yüksek50,2967

50,12%-0,15Alış50,0692Satış50,1727En Yüksek50,2967 -

EUR/USD

1,17%-0,12Alış1,1708Satış1,1709En Yüksek1,1739

1,17%-0,12Alış1,1708Satış1,1709En Yüksek1,1739 -

ALTIN

5967,26%0,21Alış5963,89Satış5970,64En Yüksek5994,10

5967,26%0,21Alış5963,89Satış5970,64En Yüksek5994,10

- Anasayfa

- Haberler

- Tüm Haberler

- Seven important developments which drive the giants

Seven important developments which drive the giants

Here are the seven important developments and their effects on performances in 2012...

1.06.2012 00:00:000

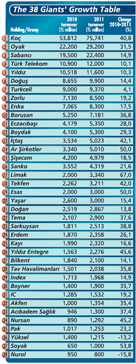

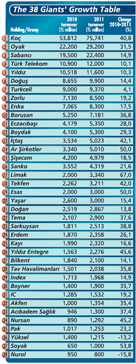

In 2011 the Turkish economy grew by 8 per cent. The giants who serve as a locomotive for the Turkish economy recorded record rates of growth. Koç Holding grew by 41 per cent, Oyak by 31.5 per cent and Sabancı by 14.9 per cent, their best performances since the crisis. It was not just these three giants, 21 of the 37 groups which participated in the "Performances of the Holdings" in Turkey survey recorded growth of between 20 per cent and 67 per cent. So what was it which, at the time when the world had not yet shaken off the effects of the crisis, enabled the giants in Turkey to grow? When we look at the big picture from the financial data from the 37 groups which serve as the locomotive for the private sector in Turkey, we see that seven important developments come to the fore. Here are the seven important developments and their effects on performances in 2012...

Click image to see the table

1-FOCUSING ON PRODUCTIVITY

1-FOCUSING ON PRODUCTIVITY

Many groups declared that 2011 was the year of productivity. Memduh Boydak, the CEO of Boydak Holding, stressed this. “In 2011 it was our strategy of focusing on productivity which enabled us to continue growth and exceed our targets. 2011 was a year in which we increased our productivity,” he says. Yıldız Holding CFO Cem Karakaş explains that they managed their existing operations in a more effective and productive manner and focused on continually improving their profitability. For Doğan Holding, 2011 was a year of progress in sustainable growth in the full sense of the word and ensuring an increase in productivity. The Holding’s CEO Yahya Üzdiyen says that they disposed of some of their assets. “As a result we were able to strengthen our capital structure,” he says.

2-İNVESTMENTS PICKED UP

2011 was really a very lively year in terms of investments. Both of the two giants of the private sector invested heavily: Koç Holding realized investments of TL 2.9 billion, while Sabancı Holding increased its investments by 29 per cent compared with the previous year to TL 1.4 5 billion. Nor do the giants have any intention of hitting the brakes in investments this year, Koç Holding CEO Turgay Durak expects 2012 to be a record year in terms of investments. “This year we are aiming to double our combined investments to TL 6.5 billion,” he says. Sabancı Holding CEO Zafer Kurtul says that they will make investments of TL 2 billion.

3-A FLURRY OF ACQUISITIONS

Last year many groups grew through acquisitions. Koç Holding bought the 100-year-old South African white goods giant Defy, while Zorlu Holding bought four white goods brands from the Italian Antonio Merloni company. Doğuş Holding bought Star television to strengthen its position in the, while Yıldız Holding did likewise in retailing by acquiring the Şok Supermarkets. Now all of the groups are making growth plans based on future mergers and acquisitions. Koç Holding CEO Turgay Durak says that they will closely follow different opportunities both in Turkey and elsewhere in the world. Zorlu Holding Ahmet Zorlu says that they are looking to increase their exports through transactions such as the acquisitions they realized last year.~

4-THE SYNERGY THAT COMES WITH NEW 4 BUSINESS

Last year Zorlu Holding entered the LED lighting sector with a 100 per cent production target. Boyner Holding entered the e-commerce sector with its Morhipo company Doğuş Holding also took some steps in e-commerce,

Doğuş Holding CEO Hüsnü Akhan says: “We are planning to continue to grow in different technology intensive areas through the cooperation that we have begun in e-commerce with the SK Group. Secondly, we have established a partnership with the Related Group which is active in e-marketing.

5-CLOSELY MONITORING RISKS

Many group executives acknowledge that they are now looking at risks more cautiously. They say that in the months ahead they will monitor and evaluate risks more closely. Koç Holding CEO Turgay Durak stresses that they are pursuing a more wary growth strategy. He says that in 2012 they will continue to take measures and employ tight risk management policies, Boyner Holding Board Chair Cem Boyner says that this year their strategies aimed at securing sustainable and profitable growth with risk-free investments without reducing their targets. Zorlu Holding Chair Ahmet Zorlu says: “Acting cautiously is one of the keys to our growth.”

6-THOSE WHO CANNOT YET RETURN TO O BEFORE THE CRISIS

Even though many groups and holdings had an extremely good year last year there are still some groups which have yet to return to the period before the crisis. Bilkent Holding CFO Önder Sezgi says: “In order to overcome the crisis we are avoiding risky business and conducting acquisitions in line with the holding’s strategies.” He adds that it will only be possible to get back to the levels of before the crisis in 2013. It looks as if the Pak Group and Sarkusyan have still not shaken off the effects of the crisis. Pak Group officials explain that the introduction of investments to secure productivity and capacity increases in particular has enabled the cardboard sector to record a striking performance.

7-HIGH APPETITE 7 FOR GROWTH

The giants have considerable appetite for future growth. Yıldız Entrege is planning growth of 40 per cent, İçtaş of 39 per cent, the Acıbadem Health Group 35 per cent, Boyner 30 per cent, Limak 20 per cent, and Zorlu nearly 18 per cent. In 2012, Koç Holding is aiming to increase its consolidated turnover by 9 per cent to over TL 80 billion. Companies are looking to grow both in sectors in which they are already active and in new ones. A very large number of them are following opportunities both in privatization and abroad.

Click image to see the table

1-FOCUSING ON PRODUCTIVITY

1-FOCUSING ON PRODUCTIVITYMany groups declared that 2011 was the year of productivity. Memduh Boydak, the CEO of Boydak Holding, stressed this. “In 2011 it was our strategy of focusing on productivity which enabled us to continue growth and exceed our targets. 2011 was a year in which we increased our productivity,” he says. Yıldız Holding CFO Cem Karakaş explains that they managed their existing operations in a more effective and productive manner and focused on continually improving their profitability. For Doğan Holding, 2011 was a year of progress in sustainable growth in the full sense of the word and ensuring an increase in productivity. The Holding’s CEO Yahya Üzdiyen says that they disposed of some of their assets. “As a result we were able to strengthen our capital structure,” he says.

2-İNVESTMENTS PICKED UP

2011 was really a very lively year in terms of investments. Both of the two giants of the private sector invested heavily: Koç Holding realized investments of TL 2.9 billion, while Sabancı Holding increased its investments by 29 per cent compared with the previous year to TL 1.4 5 billion. Nor do the giants have any intention of hitting the brakes in investments this year, Koç Holding CEO Turgay Durak expects 2012 to be a record year in terms of investments. “This year we are aiming to double our combined investments to TL 6.5 billion,” he says. Sabancı Holding CEO Zafer Kurtul says that they will make investments of TL 2 billion.

3-A FLURRY OF ACQUISITIONS

Last year many groups grew through acquisitions. Koç Holding bought the 100-year-old South African white goods giant Defy, while Zorlu Holding bought four white goods brands from the Italian Antonio Merloni company. Doğuş Holding bought Star television to strengthen its position in the, while Yıldız Holding did likewise in retailing by acquiring the Şok Supermarkets. Now all of the groups are making growth plans based on future mergers and acquisitions. Koç Holding CEO Turgay Durak says that they will closely follow different opportunities both in Turkey and elsewhere in the world. Zorlu Holding Ahmet Zorlu says that they are looking to increase their exports through transactions such as the acquisitions they realized last year.~

4-THE SYNERGY THAT COMES WITH NEW 4 BUSINESS

Last year Zorlu Holding entered the LED lighting sector with a 100 per cent production target. Boyner Holding entered the e-commerce sector with its Morhipo company Doğuş Holding also took some steps in e-commerce,

Doğuş Holding CEO Hüsnü Akhan says: “We are planning to continue to grow in different technology intensive areas through the cooperation that we have begun in e-commerce with the SK Group. Secondly, we have established a partnership with the Related Group which is active in e-marketing.

5-CLOSELY MONITORING RISKS

Many group executives acknowledge that they are now looking at risks more cautiously. They say that in the months ahead they will monitor and evaluate risks more closely. Koç Holding CEO Turgay Durak stresses that they are pursuing a more wary growth strategy. He says that in 2012 they will continue to take measures and employ tight risk management policies, Boyner Holding Board Chair Cem Boyner says that this year their strategies aimed at securing sustainable and profitable growth with risk-free investments without reducing their targets. Zorlu Holding Chair Ahmet Zorlu says: “Acting cautiously is one of the keys to our growth.”

6-THOSE WHO CANNOT YET RETURN TO O BEFORE THE CRISIS

Even though many groups and holdings had an extremely good year last year there are still some groups which have yet to return to the period before the crisis. Bilkent Holding CFO Önder Sezgi says: “In order to overcome the crisis we are avoiding risky business and conducting acquisitions in line with the holding’s strategies.” He adds that it will only be possible to get back to the levels of before the crisis in 2013. It looks as if the Pak Group and Sarkusyan have still not shaken off the effects of the crisis. Pak Group officials explain that the introduction of investments to secure productivity and capacity increases in particular has enabled the cardboard sector to record a striking performance.

7-HIGH APPETITE 7 FOR GROWTH

The giants have considerable appetite for future growth. Yıldız Entrege is planning growth of 40 per cent, İçtaş of 39 per cent, the Acıbadem Health Group 35 per cent, Boyner 30 per cent, Limak 20 per cent, and Zorlu nearly 18 per cent. In 2012, Koç Holding is aiming to increase its consolidated turnover by 9 per cent to over TL 80 billion. Companies are looking to grow both in sectors in which they are already active and in new ones. A very large number of them are following opportunities both in privatization and abroad.

Türkiye ve dünya ekonomisine yön veren gelişmeleri yorulmadan takip edebilmek için her yeni güne haber bültenimiz “Sabah Kahvesi” ile başlamak ister misiniz?