-

BIST 100

10149,89%0,42En Düşük10110,75En Yüksek10203,58

10149,89%0,42En Düşük10110,75En Yüksek10203,58 -

DOLAR

40,01%0,13Alış40,0090Satış40,0190En Yüksek40,0238

40,01%0,13Alış40,0090Satış40,0190En Yüksek40,0238 -

EURO

47,09%0,65Alış47,0868Satış47,0947En Yüksek47,1245

47,09%0,65Alış47,0868Satış47,0947En Yüksek47,1245 -

EUR/USD

1,18%0,39Alış1,1754Satış1,1755En Yüksek1,1768

1,18%0,39Alış1,1754Satış1,1755En Yüksek1,1768 -

ALTIN

4279,23%-0,23Alış4278,69Satış4279,76En Yüksek4302,66

4279,23%-0,23Alış4278,69Satış4279,76En Yüksek4302,66

-

BIST 100

10149,89%0,42En Düşük10110,75En Yüksek10203,58

10149,89%0,42En Düşük10110,75En Yüksek10203,58 -

DOLAR

40,01%0,13Alış40,0090Satış40,0190En Yüksek40,0238

40,01%0,13Alış40,0090Satış40,0190En Yüksek40,0238 -

EURO

47,09%0,65Alış47,0868Satış47,0947En Yüksek47,1245

47,09%0,65Alış47,0868Satış47,0947En Yüksek47,1245 -

EUR/USD

1,18%0,39Alış1,1754Satış1,1755En Yüksek1,1768

1,18%0,39Alış1,1754Satış1,1755En Yüksek1,1768 -

ALTIN

4279,23%-0,23Alış4278,69Satış4279,76En Yüksek4302,66

4279,23%-0,23Alış4278,69Satış4279,76En Yüksek4302,66

- Anasayfa

- Haberler

- Tüm Haberler

- “We are the leader in Anatolia and are targeting Istanbul”

“We are the leader in Anatolia and are targeting Istanbul”

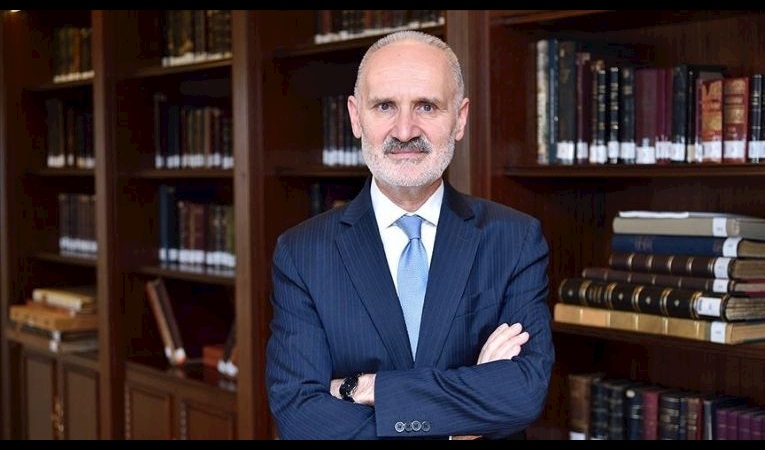

Vakıfbank aims to be one of the three leading banks in the sector in the next five years. Vakıfbank General Manager Bilal Karaman says: “We are already the leading bank in many cities in Anatolia. ...

Vakıfbank aims to be one of the three leading banks in the sector in the next five years. Vakıfbank General Manager Bilal Karaman says: “We are already the leading bank in many cities in Anatolia. But we are weaker than the other banks in Istanbul.” He adds: “Our goal is to open nearly 50 branches in 2007. We shall open approximately half of these in Istanbul.”

At the end of 2004 Vakıfbank began working with a consulting company and developed a new roadmap for the company. The first plan was to hold a public offering to overcome the bank’s lack of capital. First of all in 2005 25 percent of its shares were sold to the public. Afterwards a comprehensive restructuring program was launched at Vakıfbank. This included giving priority to a customer-focused structure, renewing the technological infrastructure, strengthening marketing activities and opening corporate centers and new branches.

Vakıfbank’s current targets include replicating its strength in Anatolia in Istanbul and the Marmara Region. General Manager Bilal Karaman had the following to say about future projections: “We shall expand in individual and SME loans. We shall acieve this growth in Istanbul and the Marmara Region. In 2007 we shall open nearly 50 new branches, half of them in Istanbul. We shall be one of the leading banks in the sector in terms of profitability.”

We spoke with Vakıfbank General Manager Bilal Karaman about the last three years, his growth plans and his targets for the future:

* How was 2006 for Vakıfbank? What were the year-end balance sheet figures like?

In general, 2006 was a good year for Vakıfbank. We emphasized credits within the scope of the policies we applied. We reduced the share of securities in our balance sheet and tried to increase the share of loans. We gave profitability the priority. This had a minor negative impact on the size of our assets but we were expecting this anyway. In the end, in 2006 we just about achieved the results we had aimed for in our balance sheet items.

Our loans reached YTL 18 billion by the end of the year. Even though we had not sought to increase the size of our deposits we secured growth of around 7 percent in our assets. Our total assets grew to YTL 37 billion. We closed the year with YTL 25 billion in deposits. In 2006 our profits were YTL 770 million.

* What are your plans and targets for 2007? What are your projections for the end of this year?

We shall continue with our growth policy. In this regard, we shall give particular importance to increasing our loans. We have aggressive targets in SME and individual loans in particular. We aim to open nearly 50 branches in 2007. Around half of these will be in Istanbul. We are also aiming being one of the leading banks in the sector in terms of profitability in 2007. We have been applying a restructuring program in our bank for some time. A significant proportion of this program has now been completed. Our calculations are that in 2007 this project will have an even greater impact in terms of increasing revenue and controlling costs.

Hande D. Süzer

[email protected]

Türkiye ve dünya ekonomisine yön veren gelişmeleri yorulmadan takip edebilmek için her yeni güne haber bültenimiz “Sabah Kahvesi” ile başlamak ister misiniz?